In today's digital era, the financial industry is undergoing unprecedented changes. With the rapid development of technology, digital finance has become an important part of the global economy, providing people with unprecedented convenience. However, at the same time, the globalization and regionalization of digital risks have become increasingly prominent, bringing brand new challenges to digital finance in the new era.

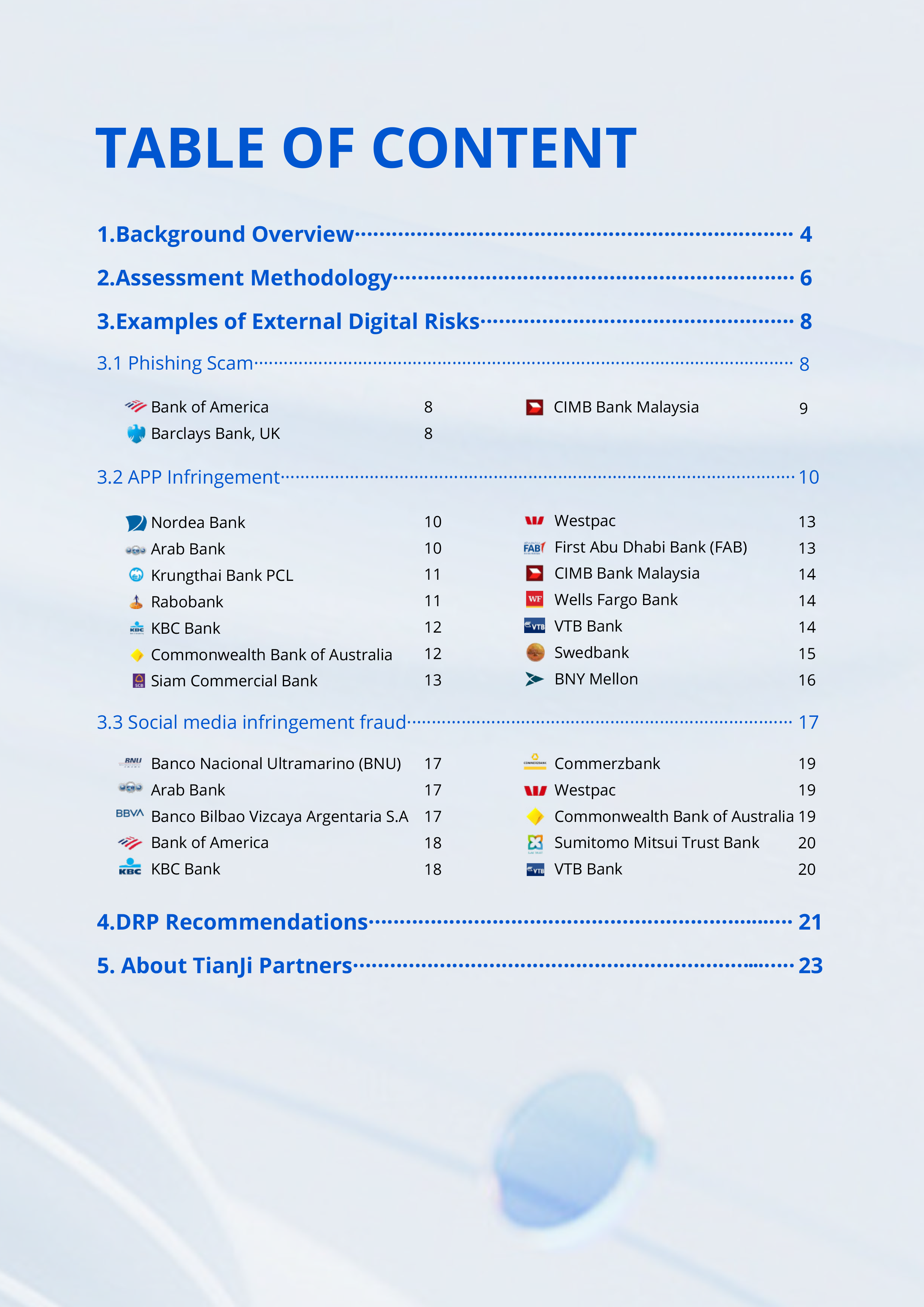

In the wave of globalization, the propagation speed and scope of digital risks have been greatly expanded. Phishing, counterfeiting, copyright infringement, fraud and other behaviors not only occur frequently on traditional websites and APPs, but also proliferate on major social media platforms. These risks not only threaten the safety of users' property, but also pose a severe test to the reputation and business development of financial institutions.

Especially in China, due to its unique culture, language and market environment, foreign banks face more complex digital risk challenges when conducting business in China. The rapid development and wide application of digital platforms in China make it imperative for foreign banks to take effective measures to address external digital risks based on a full understanding of and adaptation to these characteristics.

This report aims to provide an in-depth analysis of the globalized and territorialized characteristics of external digital risks, explore their impact on digital finance in the new era, and propose corresponding strategies and recommendations for foreign banks to deal with the special challenges they face when conducting business in China. Through an in-depth study of these issues, this report

hopes to provide valuable reference and guidance for the sound development of foreign banks' business in China, and to promote the healthy and sustainable development of the financial industry.